Thinking about buying a home in Rhode Island but worried about the down payment? You’re not alone. Homeownership often feels just out of reach, especially when prices are inching up, and mortgage rules seem more complicated than ever.

But here’s the good news: FHA loans solve your problem, and it makes it possible for thousands of first-time and moderate-income buyers to step confidently into the housing market.

This 2025 guide dives deep into one of the most common questions among homebuyers in RI: How much is the minimum down payment for a $250,000 FHA loan? We’ll break it down clearly — from what you need to qualify, how much you should earn, what kind of credit score helps, and even how you can get thousands in down payment assistance.

Plus, we’ll bring in insights from RI Mortgage Brokers so you get real advice, not just theory.

FHA Loans in Rhode Island: A Quick Overview

FHA loans are government-backed mortgages insured by the Federal Housing Administration. Unlike conventional loans, they’re designed to help buyers who might not have perfect credit or a massive savings account. They’ve been a favorite among first-time homebuyers in Rhode Island — and for good reason.

So, who are FHA loans best for? Generally:

- First-time homebuyers

- Low-to-moderate income earners

- People with fair credit scores

- Buyers with limited down payment funds

In Rhode Island, where the average home price is hovering near $400,000 in some areas but remains closer to $250,000–$300,000 in others, FHA loans are a game changer. That’s especially true in towns like Cumberland, Johnston, and Warwick, where $250K homes are still available and desirable.

Beyond affordability, FHA loans stand out for a few key perks:

- Low minimum down payment: As low as 3.5%

- Flexible credit requirements: Qualify with scores as low as 580

- Assistance-friendly: You can use gift funds or government programs to help cover costs

All in all, FHA loans keep the door to homeownership wide open — even if you’re walking in with a modest budget.

Learn More on FHA Loan: What Is an FHA Loan and How Does It Work in 2025 Rhode Island?

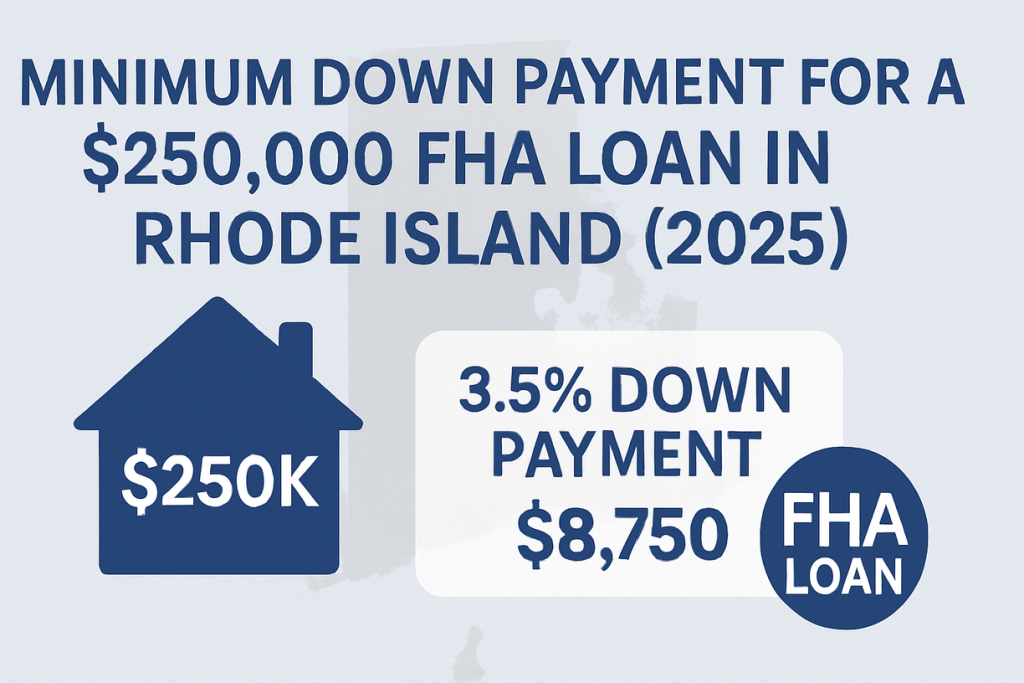

What’s the Minimum Down Payment for a $250,000 FHA Loan in Rhode Island?

Let’s get straight to the math. If you’re planning to buy a $250,000 home in Rhode Island using an FHA loan in 2025, here’s what your down payment could look like:

- Standard FHA down payment (with 580+ credit score):

- 3.5% of $250,000 = $8,750

- If your credit score is between 500–579:

- You’ll need a 10% down payment, which is $25,000

Now, it’s important to note: These are just the minimums. Many buyers choose to pay more upfront if they can, which can reduce monthly payments and avoid costly mortgage insurance in the long run.

Don’t forget closing costs. These often run between 2%–5% of the home price, so in this case, you’re looking at another $5,000–$12,500.

But there’s more good news: Rhode Island Housing offers down payment assistance programs that could provide up to $15,000 toward your home purchase. That could potentially wipe out your entire down payment or help you cover those sneaky closing costs.

Here’s a Quick Breakdown of Common Scenarios:

Credit Score |

Down Payment % |

Down Payment Amount |

With $15K Assistance |

| 580+ | 3.5% | $8,750 | $0 out-of-pocket |

| 500–579 | 10% | $25,000 | $10,000 left to pay |

| 620+ | 3.5% | $8,750 | Full coverage |

How Much Do You Need to Make to Afford a $250K Home in Rhode Island (FHA Loan)?

Now let’s talk about income. How much do you need to earn each year to afford a $250,000 home using an FHA loan realistically?

FHA uses two key debt-to-income (DTI) ratios:

- Front-end DTI: Up to 31% of your gross monthly income can go to your mortgage.

- Back-end DTI: Up to 43% can go to all debts (mortgage + credit cards, car loans, etc.).

Let’s crunch some numbers:

- Monthly mortgage (including taxes and insurance): ~$1,800

- To keep that under 31%, your monthly income should be: ~$5,800

- Annually, that’s around $70,000

Of course, this number can shift based on your current debt. If you have minimal monthly debts, you could qualify with as little as $65,000. If you have student loans or a car payment, you might need to earn $75,000–$80,000 to stay within safe limits.

Also factor in:

- Property taxes in RI: Can range from 1.3%–2% of home value annually

- Homeowners insurance: Typically $800–$1,200 per year

Using a mortgage calculator can help you test different income/debt/down payment combos, and RI Mortgage Brokers can help run those numbers with real-time accuracy based on your profile.

Learn More: FHA loan limit in Rhode Island for 2025

How Much Is a Down Payment on a $250K FHA Loan (Reinforced)?

Let’s revisit the down payment concept — but with more detail and context.

There’s a big difference between the minimum and the recommended down payment.

Minimum (3.5%) = $8,750It is your entry-level cost if you have a 580+ credit score. It gets you into the FHA world. Recommended = 5%–10% or more.

Why pay more? Because of a higher down payment:

- Lowers your loan balance

- Reduces monthly payments

- Helps you avoid long-term mortgage insurance

- Makes your offer stronger in competitive markets

Now let’s explore how this plays out in real life:

1: 3.5% Down, No Assistance

- Down payment = $8,750

- Closing costs = ~$7,000

- Total cash needed = $15,750

2: 3.5% Down + $15K RI Housing Assistance

- Down payment = $8,750 (covered)

- Closing costs = $7,000 (partially covered)

- Total cash needed = $750 or less

3: 10% Down (Low Credit Buyer)

- Down payment = $25,000

- Closing costs = $7,000

- Total = $32,000

- With $15K aid = $17,000 out-of-pocket

Also worth noting: FHA allows gift funds from family or close friends. That means grandma can help you get the keys to your first home — legally and happily.

What Is the Best FHA Loan Rate in Rhode Island Today?

Rates change fast — but in 2025, FHA rates in Rhode Island are averaging between 6.25% to 6.75%, depending on the broker and your credit.

These are usually lower than conventional loan rates, making FHA an even better deal for buyers with average credit or smaller down payments.

But what exactly determines your individual FHA rate? Several key factors come into play:

-

Credit Score

It is one of the most influential factors. A higher Credit Score — ideally above 680 — will usually get you closer to the lower end of the FHA rate spectrum. If your score is hovering around 580–620, you can still qualify, but expect a slightly higher rate.

-

Loan Term

The length of your loan also matters. While the 30-year fixed FHA mortgage is the most common, choosing a 15-year term often results in a lower interest rate. However, keep in mind that shorter terms come with higher monthly payments.

-

Property Type

What kind of home are you buying? Rates may vary for single-family homes, condos, and multi-family properties. For example, multi-unit properties could carry slightly higher rates due to their increased risk profile, especially if you plan to live in one unit and rent the others.

-

broker Variation

Not all brokers offer the same rate. In fact, FHA loans are insured by the federal government but issued by individual brokers, meaning each broker sets their rates and fees. It is why it’s absolutely crucial to shop around and compare offers.

-

Market Conditions

Broader economic trends also influence FHA loan rates. Inflation, Federal Reserve policy, and investor demand for mortgage-backed securities all play a role. Rates in early 2025, for instance, are slightly higher than the historic lows seen in 2021–2022, but they remain affordable compared to long-term averages.

Here’s a general snapshot to give you an idea of how credit scores impact FHA rates in RI:

Credit Score |

Estimated FHA Rate (2025) |

| 580–619 | ~6.75% |

| 620–679 | ~6.50% |

| 680+ | ~6.25% |

How Do You Qualify for a $250K FHA Mortgage in RI?

FHA makes things easier — but not automatic. Here’s what you need to qualify:

- Credit Score: 580+ for 3.5% down (500+ for 10% down)

- Income History: At least two years of steady employment (W-2s, tax returns if self-employed)

- DTI: Generally below 43% — lower is better

- Property Standards: The Home must pass an FHA appraisal

- Occupancy: You must live in the home — no investment properties allowed

It helps to start with a pre-approval. That way, you’ll know exactly what you qualify for and can shop confidently.

Not Sure If You Meet the Requirements?

That’s where RI Mortgage Brokers come in. We work with buyers in every financial situation — even those who don’t quite check every box. Whether it’s helping you boost your credit, find the right assistance program, or choose a more flexible broker, they’ll help guide you through.

Before budgeting your down payment, check who qualifies for an FHA loan in Rhode Island so you’re confident you meet the requirements.

How to Boost Your FHA Loan Approval Odds in Rhode Island

Even if you meet the basic FHA loan requirements, taking a few extra steps can significantly strengthen your mortgage application and improve your chances of approval, possibly even securing you better loan terms.

Here are some practical ways to boost your FHA loan readiness:

-

Improve Your Credit Score

Even a 20-point increase can lower your interest rate and monthly payment. Pay off small credit card balances, dispute errors on your credit report, and avoid new debt before applying.

-

Reduce Your Debt-to-Income Ratio (DTI)

brokers want to see that your income comfortably covers your debts. Pay down high-interest debt, consolidate where possible, and avoid co-signing on any new loans.

-

Save More for Closing Costs

While FHA loans are flexible, having some reserves in the bank shows brokers you’re financially stable. Plus, you’ll be better prepared for unexpected expenses during the buying process.

-

Get Pre-Approved, Not Just Pre-Qualified

A pre-approval letter from RI Mortgage Brokers carries more weight with sellers and helps you shop with a clear budget in mind.

- Take a Homebuyer Education Course

Not only do many assistance programs in Rhode Island require it, but it also prepares you for mortgage responsibilities and shows brokers you’re serious about ownership.

Final Thought

FHA loans continue to be one of the most practical and accessible options for homebuyers in Rhode Island, especially for those eyeing properties around the $250,000 mark. With a low minimum down payment of just 3.5% and more forgiving credit requirements, these loans open doors for first-time buyers and moderate-income earners across the state. When you factor in the rising cost of homes and the challenges of saving for a hefty down payment,

FHA financing offers a flexible, affordable path to homeownership that many Rhode Islanders can realistically pursue.

If you’re still building your credit, managing other debts, or simply trying to navigate the market, speaking with local experts like RI Mortgage Brokers can help you explore your eligibility, secure a competitive rate, and get you pre-qualified with confidence. The road to owning your first home in Rhode Island might be closer than you think — and the right FHA loan could be your ticket in.

FAQs

-

Can I use gift money for the FHA down payment in Rhode Island?

Yes, absolutely. FHA allows you to use gift funds from a family member, employer, or even a charitable organization. As long as the money is properly documented (with a signed gift letter and proof of transfer), it’s a great way to reduce or eliminate your upfront cost.

-

What credit score do I need to get an FHA loan in RI?

To qualify for the 3.5% down option, you’ll need a credit score of at least 580. If your score falls between 500 and 579, you’ll need to put down 10%. Many brokers also have their own “overlays” (extra requirements), so working with RI Mortgage Brokers can help you navigate those hurdles.

-

How long does it take to get approved for an FHA loan in Rhode Island?

Typically, from application to closing, it can take 30 to 45 days. But delays may happen if documentation is missing or if the home needs repairs to meet FHA standards. Getting pre-approved and submitting all documents early can speed up the process.