If you’re dreaming of buying your first home in Rhode Island but feel weighed down by credit score concerns or a limited budget, you’re not alone. Thousands of first-time buyers face this same uphill climb. Fortunately, there’s a powerful solution designed with you in mind — FHA loans.

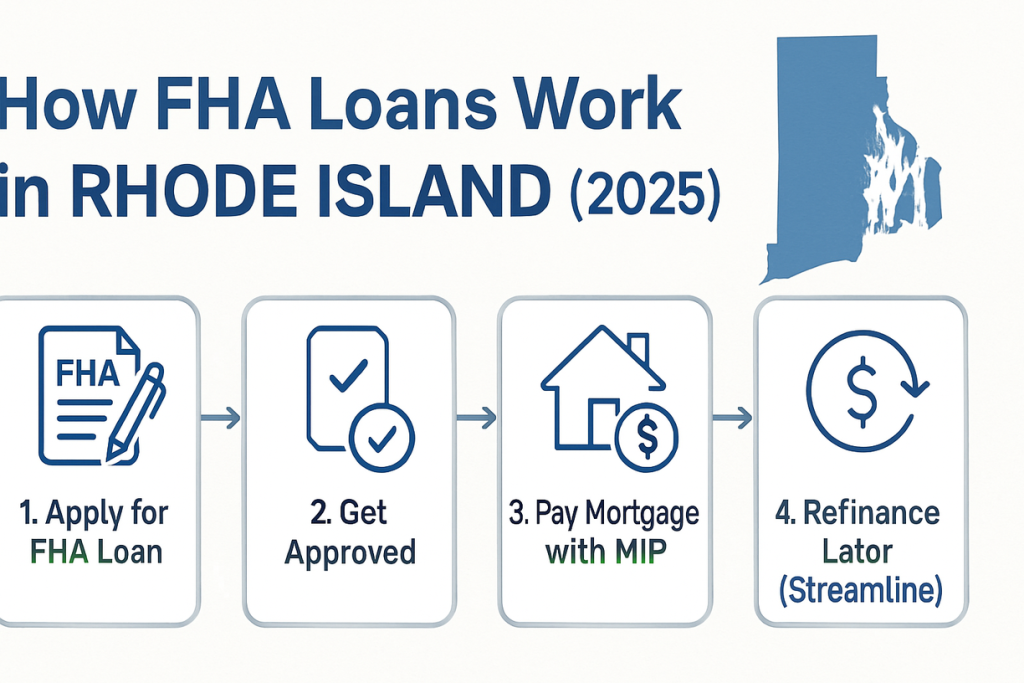

So, what is an FHA loan, and how does it work in 2025 Rhode Island? Simply put, it’s a government-backed mortgage that opens doors for buyers who might not otherwise qualify for traditional loans.

Backed by the Federal Housing Administration, this loan option is especially helpful for those with modest income or lower credit scores. Let’s walk through everything you need to know about fha loan its types, qualifications, credit score expectations, and why RI Mortgage Brokers is your top choice for navigating the FHA process in Rhode Island.

FHA Loans Overview: A First-Time Buyer’s Best Friend in Rhode Island

Imagine trying to run a race with one shoe untied — that’s what buying a home can feel like when your credit isn’t perfect or your down payment isn’t huge. It is where FHA loans step in. Backed by the U.S. Department of Housing and Urban Development (HUD), FHA loans are tailored to reduce financial obstacles and make homeownership achievable for more people.

With as little as 3.5% down, flexible credit standards, and competitive interest rates, it’s no wonder that FHA loans are the go-to choice for first-time homebuyers in Rhode Island.

Types of FHA Loans Available First-Time Home Buyer’s

The FHA loan family isn’t one-size-fits-all. Whether you’re a first-time homebuyer, a homeowner looking to refinance, or someone interested in renovations or energy efficiency, there’s likely an FHA loan tailored to your situation. Here’s a deeper dive into the key types available in 2025:

-

FHA 203(b) Loan

It is the most common and straightforward FHA loan. It’s used for purchasing or refinancing a primary residence. With just a 3.5% down payment requirement (if your credit score is 580+), it’s the go-to choice for many first-time homebuyers in Rhode Island. It allows for flexible credit guidelines and competitive interest rates—perfect for buyers with moderate incomes.

-

FHA 203(k) Rehabilitation Loan

Planning to buy a home that needs some TLC? The 203(k) loan is your friend. It bundles the cost of the home purchase and renovation into a single loan. Whether it’s a minor repair or major structural work, you can finance it all under one convenient plan.

There are two types:

- Standard 203(k) – For major repairs or structural renovations.

- Limited 203(k) – For minor, non-structural updates under $35,000.

This loan is especially useful in areas like Providence or Warwick, where older homes may need updates but still offer excellent value.

-

FHA Energy Efficient Mortgage (EEM)

Green living is more than a trend—it’s a smart investment. The EEM lets you roll the cost of energy-efficient upgrades (like solar panels, insulation, new HVAC systems) into your mortgage. It doesn’t require a separate loan or a second closing.

By lowering utility bills, you increase your home’s efficiency while boosting long-term affordability.

-

FHA Reverse Mortgage (HECM)

For homeowners aged 62 and older, this loan allows you to convert a portion of your home’s equity into cash, either as a lump sum, monthly payments, or a line of credit.

You keep the title and stay in your home as long as it’s your primary residence, and you meet basic maintenance and tax obligations. It’s an excellent option for seniors looking to supplement retirement income.

-

FHA Streamline Refinance

Already have an FHA loan and want to refinance to a lower rate without the paperwork hassle? The Streamline Refinance option is your answer.

- No appraisal is required in most cases.

- No income verification.

- Minimal documentation.

- It’s the fastest way to reduce your interest rate and monthly payments—ideal when rates drop in 2025.

What Are the Benefits of an FHA Loan in Rhode Island?

FHA loans are one of the most accessible mortgage options in 2025, especially for first-time homebuyers and those with less-than-perfect credit. Backed by the Federal Housing Administration, these loans are designed to make homeownership more achievable for everyday Rhode Islanders. Here’s what makes them so beneficial:

-

Low Down Payment Requirements

One of the biggest advantages of an FHA loan is the minimal down payment. You can put down as little as 3.5% if your credit score is 580 or higher. It is ideal if you haven’t had years to save for a traditional 20% down payment.

-

Flexible Credit Score Standards

Unlike conventional loans that may require scores in the 700s, FHA loans are more forgiving. Borrowers with credit scores as low as 500–579 may still qualify with a 10% down payment, and those with scores above 580 qualify with just 3.5% down.

-

Competitive Interest Rates

Because the government insures FHA loans, brokers often offer lower interest rates compared to high-risk conventional loans. It helps reduce monthly payments over time, even if you’re not a top-tier borrower.

-

Higher Debt-to-Income (DTI) Limits

FHA loans allow for higher DTI ratios, meaning you can qualify even if you have other significant debts, such as student loans or car payments. Many borrowers are approved with DTI ratios up to 43%–50%.

-

Option to Include Closing Costs

Many closing costs can be rolled into your FHA loan, reducing your need for upfront cash. Sellers can also contribute up to 6% toward your closing costs, which is more generous than some conventional options.

-

Assumable Loan Terms

FHA loans are assumable, which means if you sell your home, a qualified buyer can take over your FHA loan and its interest rate. It could be a major selling point in a high-interest-rate environment.

-

Streamlined Refinancing

If you already have an FHA loan, you can take advantage of the FHA Streamline Refinance program. It lets you refinance to a better rate with minimal paperwork, no new appraisal, and no income verification in many cases.

-

Available for Multi-Unit Properties

You can use an FHA loan to buy a 2- to 4-unit property, as long as you live in one unit. It is an incredible way to generate rental income while still qualifying for a low down payment.

Who Qualifies for an FHA Loan in Rhode Island?

If you’re wondering whether you’re the “right fit” for an FHA loan, here’s the good news: the requirements are designed to be inclusive and flexible, especially for working-class Rhode Islanders.

- First-time buyers — or anyone who hasn’t owned a home in the last three years.

- Individuals with lower credit scores or past financial hiccups.

- Buyers with limited savings for a down payment.

- People with steady employment and verifiable income.

- U.S. citizens, legal residents, or those with eligible immigration status.

You don’t need perfect credit or a huge bank balance to qualify.

RI Mortgage Brokers look at your full financial picture — including your debt-to-income ratio, credit history, and employment stability. If you’ve maintained consistent income and have manageable debts, you’re likely to meet FHA standards. Even self-employed borrowers can qualify with the right documentation.

As long as you can demonstrate the ability to repay the loan and meet a few basic financial guidelines, you’re likely a solid candidate. FHA loans are built to help everyday people take their first step into homeownership, and Rhode Island is no exception.

Want to know if you meet these rules? Here’s exactly who qualifies for an FHA loan in Rhode Island and what lenders look for.”

What Credit Score Do You Need for an FHA Loan?

Let’s get specific: to qualify for an FHA loan in 2025, you’ll need a minimum credit score of 580 if you’re planning to put down 3.5%.

If your score falls between 500 and 579, you can still qualify — but you’ll need to put down at least 10%. That might sound steep, but for many buyers, it still beats conventional loan requirements.

Got Bad Credit? Here’s What to Do

Don’t let a low score scare you off — FHA loans are designed to help people with less-than-perfect credit. In fact, you may still qualify with a credit score as low as 580 (or even 500 with a higher down payment). But the better your credit, the better your loan terms. Here’s how you can boost your approval odds:

-

Pay Off Small Debts

Reducing your credit utilization ratio (the amount you owe vs. your credit limit) is one of the fastest ways to raise your score. Even paying down a few hundred dollars can make a noticeable difference.

-

Dispute Errors on Your Credit Report

Many people have inaccurate items that drag their scores down. Review your report for outdated accounts, incorrect balances, or duplicate entries, and dispute anything that looks wrong.

-

Avoid New Credit Applications

Applying for credit cards, personal loans, or car financing in the months before your mortgage application can lower your score and raise red flags.

-

Get A Co-Signer

If you have someone with strong credit and stable income willing to co-sign, it could strengthen your application significantly.

-

Partner with FHA-Savvy Brokers

Work with experienced professionals like RI Mortgage Brokers who understand FHA guidelines and can connect you with broker willing to work with credit-challenged buyers.

Patience, preparation, and the right help can turn your low score into a homeownership win.

It’s smart to understand potential downsides of FHA loans in RI too — so you’re fully prepared.

FHA Loan Requirements in Rhode Island (2025)

Let’s break down the core qualifications for an FHA loan in RI:

Requirement |

Details |

| Credit Score | 580+ (3.5% down), 500–579 (10% down) |

| Down Payment | Minimum 3.5% |

| Employment | At least 2 years of stable employment/income |

| DTI Ratio | Ideally below 43% |

| Property Requirements | Must meet FHA appraisal standards |

| Loan Limit (2025) | $524,225 for a single-family home |

| Primary Residence | Property must be used as your primary home |

| Mortgage Insurance Premium | Required (Upfront + Annual) |

FHA Loan Limits in Rhode Island (2025)

Loan limits are the maximum loan amounts set by the FHA, and they vary by county. For 2025, here’s a breakdown:

| County | Single-Family Limit |

| Providence | $498,257 |

| Kent | $498,257 |

| Washington | $498,257 |

| Bristol | $498,257 |

| Newport | $498,257 |

Note: These limits are subject to change annually based on housing market trends.

Why FHA Loans Are Perfect for First-Time Homebuyers in Rhode Island

FHA loans hit the sweet spot between flexibility and affordability. Here’s why they’re the perfect starter home financing option:

- Lower credit score thresholds remove traditional barriers.

- Smaller down payments mean you don’t have to empty your savings.

- Assumable loan options can help future buyers take over your mortgage, making resale easier.

- Lenient DTI limits let you qualify with more existing debt.

If you’re stepping into homeownership for the first time, FHA loans reduce friction and anxiety. And in a competitive Rhode Island housing market, that’s a major win.

.FHA vs VA vs Conventional Loans: A Quick Comparison

Here’s a simplified chart to help you understand the differences:

Features |

FHA Loan |

VA Loan |

Conventional Loan |

| Down Payment | 3.5% | 0% | Typically 5–20% |

| Credit Score Needed | 580+ | Varies (often 620+) | 620+ |

| PMI Required | Yes | No | Yes if <20% down |

| Eligibility | Open to all | Military-affiliated only | Open to all |

| Loan Limits | County-based | County-based | Higher flexibility |

| Best For | First-time buyers | Veterans/Active Military | Buyers with strong credit |

Why RI Mortgage Brokers Is the Best FHA Loan Broker in Rhode Island

With so many moving parts in the home loan process, you need a partner who not only understands FHA loans inside and out but also knows the Rhode Island market.

RI Mortgage Brokers brings that balance. Here’s why they stand out:

- Decades of local experience

- Tailored FHA solutions

- Personalized credit guidance

- Strong lender network with competitive rates

- 5-star service that simplifies your journey

Whether you’re just starting your homeownership journey or you’re ready to apply today, RI Mortgage Brokers is the ally you can trust to unlock the door to your first home.

Conclusion

So, what is an FHA loan, and how does it work in 2025 Rhode Island? It’s your path to homeownership when traditional loans fall short. With lower credit requirements, smaller down payments, and buyer-friendly terms, FHA loans are making the American Dream a reality for more Rhode Islanders every year.

But even the best loan needs the right broker. That’s why working with RI Mortgage Brokers is your smartest next step. Their expertise, dedication, and local insights turn a complex process into a smooth one.

Ready to take the first step toward your new home?

FAQs

1. How much down payment do I need for an FHA loan in Rhode Island?

You’ll need at least 3.5% of the purchase price if your credit score is 580 or higher; for scores between 500–579, a 10% down payment is required.

2. Can I get an FHA loan with student loan debt?

Yes! FHA loans allow a higher debt-to-income ratio than conventional loans. Brokers will consider your full financial picture, including student loans.

3. Do I need to be a first-time buyer to qualify for an FHA loan?

Not necessarily. FHA loans are open to all, but they’re most popular among first-time buyers due to their relaxed requirements.