A VA loan Rhode Island is a loan program backed by the U.S. Department of Veterans Affairs. It allows eligible veterans, living service individuals, and some spouses to buy homes with low or 0 down payments and strong protections. In 2025, the rules may have a few small updates, but the center benefits will continue to be the same.

Read this blog and you will realize the steps, fees, and commonplace traps. Then you may determine if a VA loan in Rhode Island makes sense.

What is a VA Loan?

A VA mortgage is a domestic loan subsidized by way of the VA. It is not an immediate VA present. Instead, the VA guarantees a part of the loan, which lowers the risk for loan programs. Thus, programs provide greater favorable phrases to veterans.

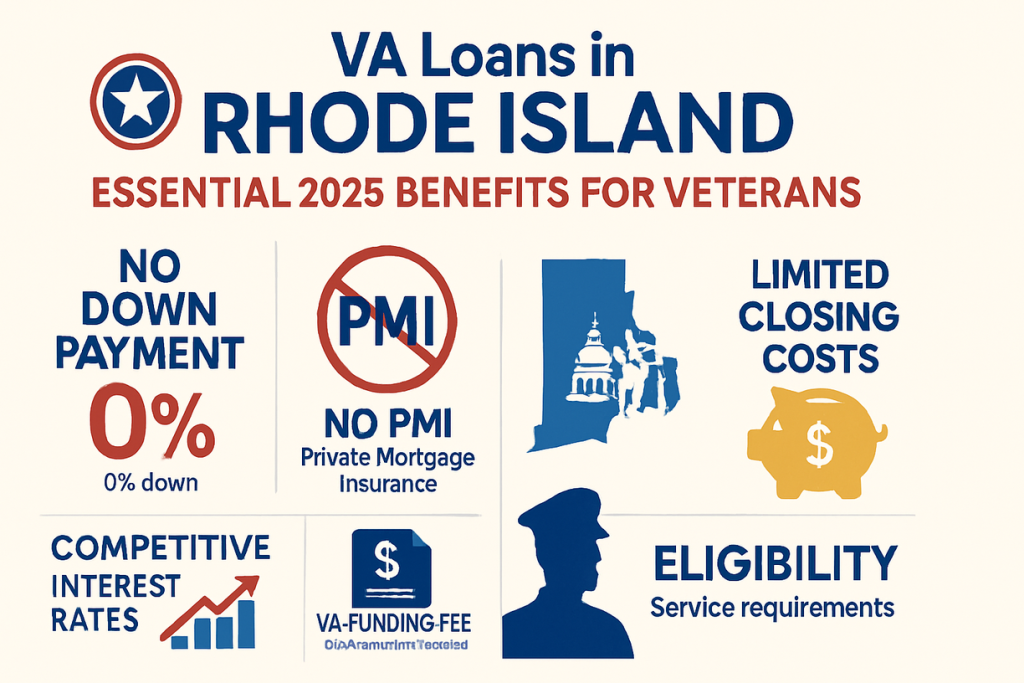

The most unusual blessings are:

- Little or no down payment.

- No non-public mortgage insurance requirement.

- Competitive hobby costs.

- Flexible credit policies compared to standard loans.

- Cash-out and buy alternatives.

Remember: the program has rules you have to follow. These regulations shield the veteran and the homebuyer market.

Who Qualifies for a VA Loan Rhode Island?

Eligibility facilities for the military provider and status. Common paths:

- Veterans who served the specified active duty time.

- Active-duty provider participants who meet the provider period rules.

- Certain National Guard and Reserve participants.

- Surviving spouses of veterans who died in a carrier or from a carrier-associated incapacity, in some instances.

You additionally want a legitimate Certificate of Eligibility (COE). A dealer or the VA allows you to get this file. With the COE in hand, you can start the application.

Why Veterans in Rhode Island Use the VA Mortgage

Rhode Island has better housing expenses in a few towns. Therefore, the no-down payment characteristic allows many local veterans to buy faster. Also, veterans often benefit from lower monthly coverage and lower down payment fee limitations.

Yet the choice relies upon your goals and local market. Use the scenarios below to peer into the way it plays out.

New Domestic in Providence: No Down Payment

Sam is a veteran who wishes for a small residence in Providence. He has a regular job. Also, he has a respectable credit score. He has little savings.

Sam makes use of a VA loan Rhode Island. He receives a permit and does not use a down payment. The seller accepts his offer. He closes and moves in.

Why this worked:

- Sam had a Certificate of Eligibility.

- He met the income and credit checks.

- The property met the VA’s minimal assets requirements.

This is not an unusual use of a VA loan in Rhode Island.

Buying the Higher-Value Newport With Some Challenges

Maria served in the Navy. She has slight financial savings. She unearths a residence in Newport. The charge is above regular VA limits in some areas, so she wishes to test entitlement and funding alternatives.

Maria’s steps:

- She examines her VA entitlement amount.

- She asks the broker about any required down payment to cover the rate over entitlement.

- Also, she negotiates vendor concessions to assist with final expenses.

Here, the VA loan Rhode Island facilitates, but Maria additionally wishes to convey finances for portions above entitlement. The VA program is bendy, but some homes may also require extra cash.

Refinance to A Decrease Rate and Faucet Fairness

Tom bought with a VA mortgage before costs dropped. Now he wants to refinance to decrease the price and pull out cash for upkeep.

He makes use of a VA Interest Rate Reduction Refinance Loan (IRRRL) or a VA cash-out refinance if he needs coins. The dealer examines eligibility and existing mortgage phrases.

Tom’s result: he lowers his price, but should weigh the closing prices. A VA refinance can be brief and fee-powerful, but no longer usually the fine pass if rates are similar.

Important VA Mortgage Rhode Island Rules for 2025

Below are the realistic guidelines that matter to Rhode Island veterans in 2025.

-

Certificate of Eligibility (COE)

You need to have a COE. It proves you meet carrier rules. Obtain it early.

-

Entitlement

Basic entitlement makes the VA assure. Full entitlement no longer implies that the VA pays the loan. Rather, it means the VA ensures a portion, so loan programs offer longer terms.

If you need a completely luxurious domestic, you may need a discount for the quantity above your available entitlement.

-

Funding Fee

Most debtors pay a one-time investment rate. It varies by means of provider reputation, down charge, and whether you use VA once more. Disabled veterans often have the price waived.

The price may be rolled into the mortgage. But rolling it will increase your balance and hobby price.

-

Property Requirements

VA minimum belongings necessities make sure the house is safe and sound. The domestic ought to meet precise guidelines for safety, sanitation, and structural soundness if an appraisal flags predominant troubles, repairs can be required.

-

Occupancy

The domestic must be your number one house. You need to pass within an affordable time after remaining.

-

Credit and Earnings

VA loans are bendy on credit score, however packages nonetheless take a look at your credit and capability to repay. In 2025, loan applications look for constant profits, acceptable DTI, and an affordable credit score history.

Quick VA Loan Comparison Points

| Topic | VA loan Rhode Island | Conventional |

| Down payment | Often 0% | Varies, often 5%+ |

| Mortgage insurance | No PMI | PMI if <20% down |

| Funding fee | One-time fee (waived for disabled vets) | No funding fee |

| Property use | Primary residence | Primary, second home, investment |

| Credit rules | Flexible | Stricter |

Common Benefits Veterans Ask About

- No PMI: The VA loan does not require private mortgage insurance, even with 0% down.

- Lower down payment needs: You can often buy with no down payment.

- Rate advantages: VA-backed mortgages often have competitive rates.

- Help for disabled veterans: Exemptions and special protections exist.

These are key reasons a VA loan Rhode Island is attractive.

Common Downsides and Traps to Watch

- Funding fee cost: This adds to your loan unless waived.

- Property condition demands: Appraisals can require repairs, which can slow closing.

- Entitlement limits: For very high-priced homes, you may need cash.

- Occupancy rule: You must live in the home as your primary residence.

- Resale limits: Some sellers worry about VA appraisal issues in tight markets.

Plan to avoid problems.

Costs to Expect With a VA Loan Rhode Island

- Down payment (often $0).

- Funding fee (one-time, unless exempt).

- Closing costs (title, appraisal, attorney, escrow, where applicable).

- Moving and initial maintenance costs.

Sellers often pay some closing costs. The funding fee can be rolled into the loan, which reduces cash at closing but increases your loan balance.

Funding Fee Examples

| Service status | No down payment | Funding fee (typical) |

| First use, regular military | 0% | ~2.15% (example) |

| Subsequent use | 0% | Higher (varies) |

| Disabled veteran | Exempt | 0% |

Note: Exact percentages are set by the VA and may change. Check current figures when you apply.

VA Loan Rhode Island; Appraisal and Repairs

The VA appraisal is not the same as a home inspection. It looks at safety, soundness, and value. If the appraisal finds issues, the underwriter lists required repairs. Options then include:

- Seller completes the repairs before closing.

- Repair escrow is set up when allowed.

- The buyer walks away if the seller refuses.

In Rhode Island, older homes and coastal properties sometimes trigger more repair items. That is why pre-offer inspections and a local broker’s help matter.

Entitlement and Buying Over the County Average Price

VA entitlement affects how much mortgage you can get without a down payment. If the home price is above the local conforming or customary sale price, you may need to bring money for the portion above entitlement. Your broker can calculate your remaining entitlement and advise whether a VA loan in Rhode Island will cover the home without extra cash.

Surviving Spouse Using Entitlement

Lisa is a surviving spouse of a veteran who died in service. She may be eligible for a VA home loan with preserved entitlement. Her path:

- Confirm eligibility via VA procedures.

- Get a COE using the spouse route.

- Apply with a broker familiar with surviving spouse rules.

This shows the VA helps families, not only veterans.

Service Member on Active Duty Buying Near the Base

Jake is on active duty and stationed near a Rhode Island base. He wants to buy a home to put down roots. He uses a VA loan Rhode Island to buy with no down payment. Because his work is steady, his pre-approval is smooth. He moves in during leave.

This scenario highlights how the VA program supports active service members.

How Rhode Island Rules and Customs Affect VA Loans

Rhode Island uses attorneys in many closings. That adds a step but also legal protection. Local property-insurance costs, flood insurance in coastal towns, and property taxes differ by town. All of these affect monthly payments.

Work with a Rhode Island mortgage broker who knows local costs and closing customs.

Tips to Strengthen Your VA Loan File

- Clean up credit mistakes early.

- Gather pay stubs, LES (for service members), tax returns, and bank statements.

- Get your COE right away.

- Choose homes in good condition to avoid repair delays.

- Plan for the funding fee or exemption.

These tips speed approval and cut stress.

Documents Checklist for VA Loan Rhode Island

| Document | Why it matters |

| Certificate of Eligibility (COE) | Proves service eligibility |

| Recent pay stubs or LES | Shows income |

| Bank statements | Shows reserves |

| W-2s / tax returns | Shows steady income |

| Photo ID and Social Security | Identity verification |

| Purchase contract | Needed to process a loan |

Bring these items early to your broker.

Final Thought

A VA loan in Rhode Island offers powerful benefits. It helps you buy with low cash and strong protection. Yet it also has rules and local issues you must check. Use the scenarios here to think through your needs. Then get a local VA-experienced broker to run the exact numbers.

If you want a clear, local check on your VA eligibility and estimate for a Rhode Island address, RI Mortgage Brokers can help. We run entitlement checks, get your COE, and give a full cost estimate.

FAQs

Do disabled veterans pay the VA funding fee?

Often, they are exempt. Check your disability status and evidence.

Can I use a VA loan again?

Yes. You may have remaining entitlement. Some repeat uses require a down payment for amounts over entitlement.

Will the VA loan cover manufactured homes?

If the home meets VA rules, ask your broker.

Are VA loans available in every Rhode Island town?

Yes, but property eligibility and local costs vary. Check local appraisal trends.